Adani Ports delivers strong quarterly performance with record revenue in logistics and marine segments, expanding beyond traditional port operations

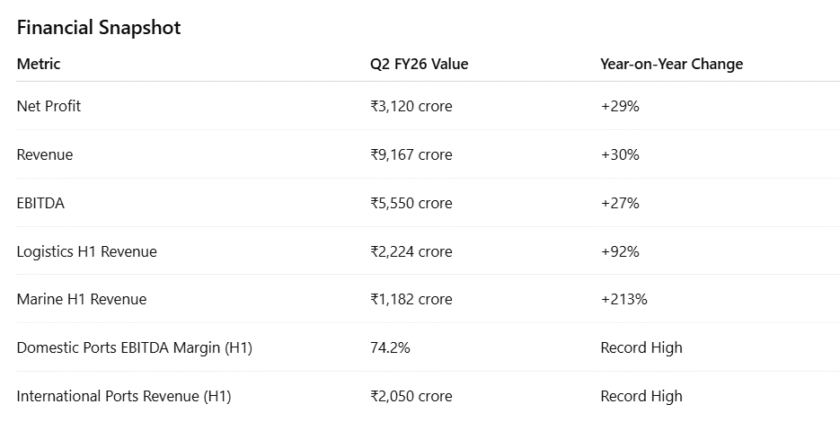

Adani Ports and Special Economic Zone Ltd (APSEZ) reported a strong quarter with double-digit growth in profit, revenue, and operational performance. For the quarter ending 30 September 2025, consolidated net profit rose 29 percent to ₹3,120 crore compared to the same period last year. Revenue from operations climbed 30 percent to ₹9,167 crore, while EBITDA increased 27 percent to ₹5,550 crore, reflecting solid financial momentum.

In the first half of FY26, total revenue reached ₹18,294 crore, a 25 percent year-on-year increase. Profit after tax stood at ₹6,431 crore, up 17 percent. The company also handled approximately 124 million metric tonnes of cargo during the quarter, a 12 percent rise from last year, showing strong demand and higher port utilization.

Logistics and Marine Businesses Drive Expansion

The growth was primarily driven by Adani Ports’ logistics and marine divisions, both achieving record numbers.

The logistics division saw revenue jump 92 percent in the first half of FY26, reaching ₹2,224 crore. Growth was fueled by expanded container and rail cargo operations, new logistics parks, and increased demand for warehousing and freight services.

Also Read: Virat Kohli Turns 37: A Story of Dreams, Determination, and Dominance

The marine division recorded a remarkable 213 percent increase in revenue year-on-year, reaching ₹1,182 crore. The surge came from higher service contracts, fleet expansion, and increased offshore and port-related activities.

Domestic port operations maintained high margins, achieving an all-time-best EBITDA margin of 74.2 percent in the first half of the year. International ports also performed strongly, generating ₹2,050 crore in revenue and ₹466 crore in EBITDA, highlighting the company’s global growth.

Expanding from Ports to Integrated Logistics

Adani Ports is evolving from a port operator into a comprehensive transport and logistics company. The strategy focuses on integrating services from the port to the customer’s doorstep, creating a seamless supply chain connecting sea routes with inland logistics, warehousing, and trucking.

The company is investing in multi-modal logistics parks, warehouse facilities, and inland freight networks, aiming to become a one-stop logistics solution across India and internationally. Its marine fleet is also expanding, with growth opportunities in West Africa and acquisitions of deep-water terminals in Australia, diversifying its operations further.

Future Outlook and Long-Term Plans

Adani Ports aims to handle one billion tonnes of cargo annually by 2030. Growth in the logistics and marine segments is part of the strategy to diversify revenue sources and reduce reliance on traditional port income.

By scaling high-margin businesses and improving operational efficiency, APSEZ is strengthening its financial position and building a balanced business model. The company expects continued growth supported by India’s expanding infrastructure, global trade opportunities, and rising domestic demand.

Financial Snapshot

Strengthening Position in Indian Trade

The results reaffirm Adani Ports’ role as a key driver in India’s trade and logistics ecosystem. Its integrated model, combining ports, logistics, marine services, and international operations, positions the company for sustainable growth.

By focusing on efficiency, diversification, and technology-driven logistics, Adani Ports is advancing toward its vision of becoming one of the world’s leading integrated transport companies. The strong quarterly results underline the company’s financial resilience and growing influence in India’s infrastructure and global trade sectors.